28+ ratio of income to mortgage

Ad Get the Right Housing Loan for Your Needs. Web The 2836 rule is a rule of thumb for managing your finances and a valuable tool in determining how much house you can afford.

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web How much of your income should go toward a mortgage.

Compare Offers Side by Side with LendingTree. The other option is to restrict the. Web The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your mortgage payment.

Web A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment. Some loan programs place more emphasis on the back-end ratio than the front-end ratio. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000.

Web Typically lenders cap the mortgage at 28 percent of your monthly income. To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Find A Lender That Offers Great Service.

Find A Lender That Offers Great Service. 1400 5000 028 which converts to 28. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. But with a bi-weekly. Begin Your Loan Search Right Here.

9000000 and 12000000. Ad Compare More Than Just Rates. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web If implemented borrowers would have to earn a gross income of 222222 for lenders to finance the purchase of a 1 million home. Keep your total debt payments at or below 40 of your pretax monthly income. For example if your monthly income is 5000 you can afford up to 1400 per month on your mortgage.

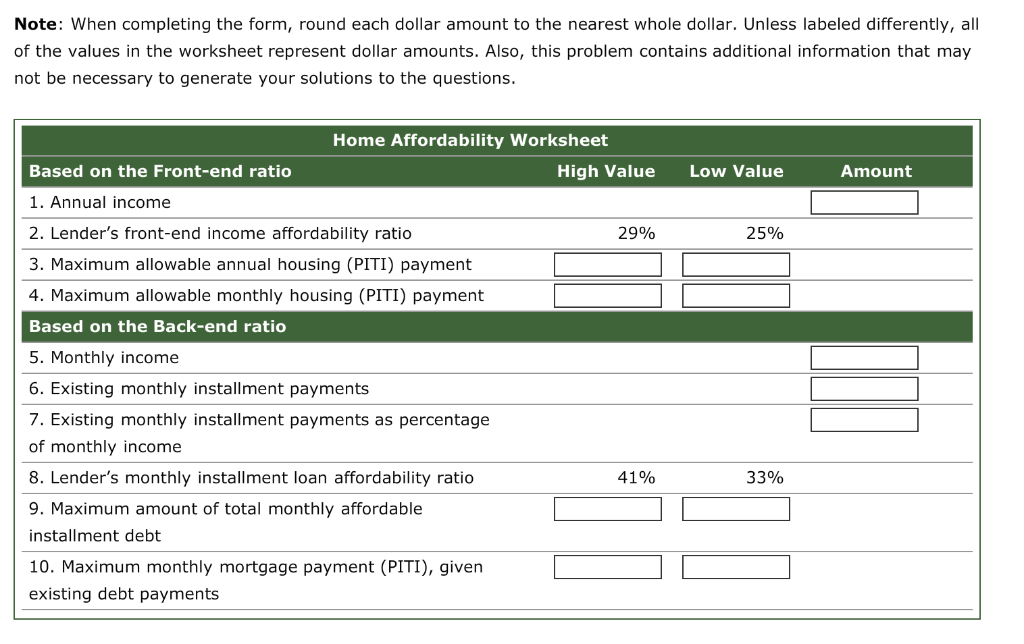

The rule says that you should. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment. The 2836 rule is a good benchmark.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Ad Compare More Than Just Rates. Be aware that lenders look at far more than the percentage of monthly income put towards a mortgage.

Explore Quotes from Top Lenders All in One Place. Ad Compare Home Financing Options Online Get Quotes. Web The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate the typical local homeowners income and the typical local home value.

Lock In Your Rate With Award-Winning Quicken Loans. Ad Compare Home Financing Options Online Get Quotes. The rule says that no more than 28 of your gross monthly income.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the 28 rule which states that no more than 28 of your gross monthly income should be spent on housing costs. Depending on your credit history credit rating and any. No more than 28 of a buyers pretax monthly income should go toward.

Lock In Your Rate With Award-Winning Quicken Loans. Web Your front-end ratio is the percentage of your annual gross income that goes toward paying your mortgage and in general it should not exceed 28. Web According to your income details the amount you are eligible to borrow is between.

Estimate Your Monthly Payment Today. Web The 28 rule refers to your mortgage-to-income ratio. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

More Veterans Than Ever are Buying with 0 Down.

80 Mlo Financial Group Mortgage Real Estate Help Ideas Mortgage Financial How To Plan

Mortgage Calculator Financial Philosophies

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

:max_bytes(150000):strip_icc()/desk-work-coffee-keyboard-technology-pen-1294988-pxhere.com-c4227f40e19d40ea935e9417e3e9f5b7.jpg)

28 36 Rule What It Is How To Use It Example

The Percentage Of Income Rule For Mortgages Rocket Money

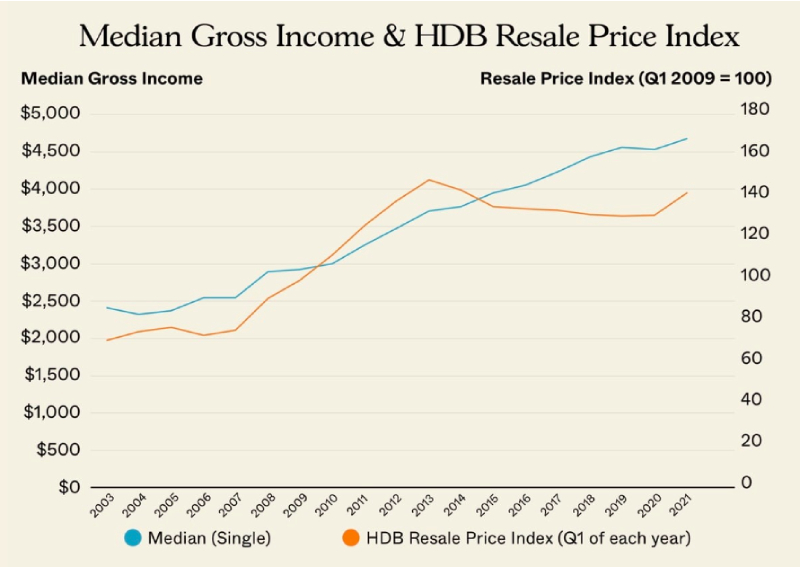

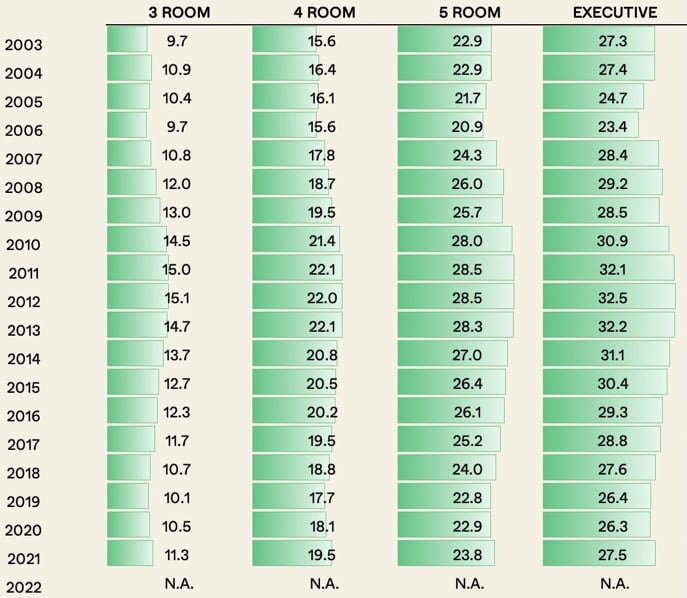

Are Hdb Flats The Most Unaffordable Today Money News Asiaone

What Is The 28 Rule In Mortgages

The 28 36 Rule How To Figure Out How Much House You Can Afford

Are Hdb Flats Really As Unaffordable As Everyone Claims We Look At 468 600 Transactions To Find Out Property Blog Singapore Stacked Homes

Profit And Gain Of Business Profession Pdf Tax Deduction Expense

The 28 36 Rule How To Figure Out How Much House You Can Afford

What Is The 28 36 Rule Lexington Law

Solved The Two Borrowing Criteria Used By Most Lending Chegg Com

Buying Your First Home Understanding Qualifying Ratios Mortgage Solutions Financial

What Percentage Of Your Income Should Go To Mortgage Chase

Shannon Janecek Operations Manager Homexpress Mortgage Corp Linkedin